Most people are familiar with the concept of a “tax bracket”, which gives the incremental rate at which income is taxed – the fraction of each additional dollar of income that you need to pay in federal tax. Or at least that’s the way it’s supposed to work. Sometimes, however, things don’t work out quite the way we expect, and the marginal tax rate is much higher than we’d expect. I came across this particular anomaly while preparing our 2018 taxes.

Tax Brackets and Rates

The tax brackets for 2018 for ordinary income (including things like salary and wages, but not capital gains) for single filers are shown in the table below. The tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%, where each rate is applied to the portion of taxable income that falls into each of the specified ranges. Taxable ordinary income is income after deductions – for 2018 the standard deduction (used if you don’t itemize) is $12000 for an individual. The bracket system is progressive – the more a taxpayer earns, the higher percentage of the extra income he pays in tax.

| Taxable Income Range |

Tax Rate |

| $0 to $9,525 | 10% |

| $9,526 to $38,700 | 12% |

| $38,701 to $82,500 | 22% |

| $82,501 to $157,500 | 24% |

| $157,501 to $200,000 | 32% |

| $200,001 to $500,000 | 35% |

| $501,000 + | 37% |

Capital gains are handled using a separate set of brackets, shown in the table below for single filers. The rates are 0%, 15% and 20%, where the rate applied depends on the taxpayer’s ordinary taxable income. This makes sense in a progressive tax system: we allow lower earners to pay lower rates on a portion of their capital gains, while higher earners are expected to pay higher rates. The approach for determining what portion of capital gains gets taxed at each rate uses the ordinary income as the “base” for the capital gains. An example will illustrate.

| Taxable Income | Long Term Capital Gains Tax Rate |

| $0 to $38,600 | 0% |

| $38,601 to $425,800 | 15% |

| $425,801 or more | 20% |

Example: Using the Brackets

Federico has income of $48000 and (long-term) capital gains of $5000 from sale of some company stock. Let’s figure out his tax due using the bracket tables. First consider the tax on his ordinary income. We begin by subtracting the standard deduction of $12000 from his ordinary (non-cap-gains) income; this leaves what’s called his taxable income as $36000. (If he itemized, this deduction might be different.) We then compute the tax due on this taxable ordinary income using the tax table above:

10% on the first $9525, or $952.50

12% on the remaining $26475, or $3177.00

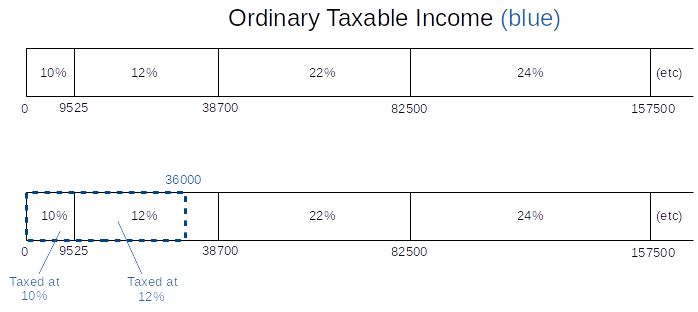

So he will have tax due of $4129.50 on his ordinary income. The diagram below shows another way to visualize the portions of his income that are taxed at the different rates.

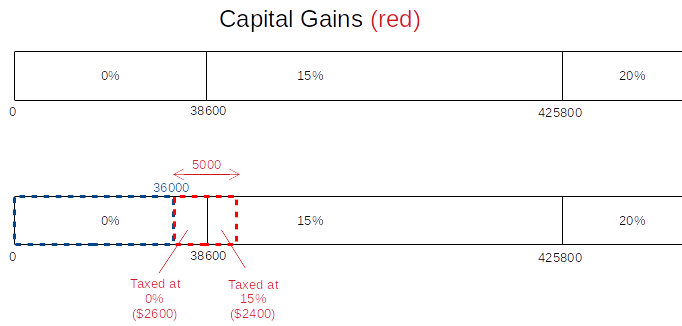

Now for his capital gains, it looks like his taxable income of $36000 puts him in the 0% cap-gains tax bracket. However, that’s a little misleading. He owes 0% just on the first $2600, which pushes his total income (ordinary plus capital gains) up to the threshold of $38600; the portion of capital gains above this is taxed at the next rate, 15%. The diagram below shows this graphically; note that the capital gains are “stacked on top” of his ordinary taxable income to see what portions are taxed at which rates.

So we compute his tax due on the capital gains as

0% on the first $2600

15% on the remaining $2400, or $360.

Thus his total tax bill will be $4129.50 + $360 = $4489.50.

A Bonus, and a Surprise

Because Federico is in the 12% tax bracket, any additional ordinary income he earns is taxed at the 12% rate until he reaches the threshold for the next bracket. So if he gets a $1000 holiday bonus, we’d expect his tax bill to go up by $120. However, there’s a catch since he has capital gains: the thresholds for this are based on his ordinary income, so that when his ordinary income goes up, more of his capital gains get shifted from the 0% bracket into the 15% bracket.

Let’s do the example. With the holiday bonus, Federico now has ordinary income of $49000, or after-deduction taxable income of $37000; the tax on this is

10% on the first $9525, or $952.50

12% on the remaining $27475, or $3297.00

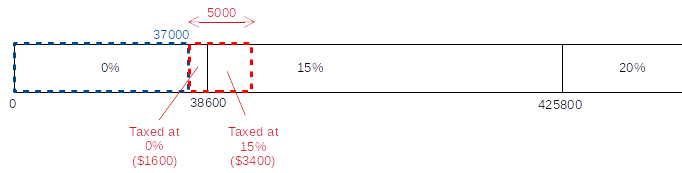

for a total of $4249.50 – exactly $120 more than the ordinary-income tax calculated above, as expected. However, when we do the calculation for his capital gains tax, we get a surprise: even though the amount of capital gains, $5000, hasn’t changed, the amount of tax due on it has, since Federico now has a higher ordinary income. With the threshold of $38600 for the lowest cap-gains bracket, and his enhanced taxable income of $37000, now only $1600 of his capital gains is in the 0% bracket, with $1000 having been “pushed up” into the higher 15% bracket by his increase in salary + bonus. The diagram below illustrates this “push-up” effect.

Thus his capital gains tax is

0% on the first $1600

15% on the remaining $3400, or $510.

This is $150 more than the cap-gains tax before, because again, his $1000 higher salary pushed $1000 of cap-gains out of the 0% bracket into the 15% bracket. So his total tax bill becomes $4249.50 + $510 = $4759.50, or $270 higher than his previous tax bill.

Thus his effective marginal tax rate is 27%: for every $100 extra he earns, he’ll have to pay $27 more in tax.

This is pretty remarkable considering that you don’t see tax rates over 25% until your taxable income is over $150,000 – those rates are supposed to be reserved for the wealthy!

This increased marginal tax rate won’t affect all taxpayers, even if they have capital gains. This will only happen when a taxpayer’s taxable income and capital gains are such that the capital gains span the boundary across the capital gains threshold of $38600, so some is taxed at 0% and some at 15%. If his taxable income is over $38600, then all of his capital gains will be in the 15% bracket already, so earning more ordinary income won’t affect the amount he pays on his capital gains; similarly, if his ordinary taxable income is below $38600, and his additional capital gains don’t reach the threshold (in which case his capital gains tax is 0% on all the cap gains), this won’t be a problem until his extra earnings are enough for the cap gains to reach the 15% threshold. And of course the same thing will hold true for the higher 15%-20% cap-gains threshold for earners whose salaries and cap gains have the cap gains straddling that threshold.

So who’s really affected? Seems like not many folks…

Well, that’s true – you have to have your salary and cap gains in a specific range for this anomaly to occur – you have to fall into a sort of “doughnut hole”. However, the size of the hole depends on the size of your capital gains – the more capital gains you have, the bigger the chance that they’ll straddle the threshold. For instance, if you have $20000 of capital gains, you’ll fall across the boundary if your taxable income is anywhere from $18600 to $38600.

Well, you might ask: who has that large a capital gain with a salary that low? Isn’t it the rich folks who have large capital gains? One constituency that can fit this description are the newly/partially retired middle class, who might still be working some but are starting to live off their nest eggs. In particular, retirement advisors recommend using savings (what are called taxable accounts) before tapping 401k’s and IRA’s. If these savings are in mutual funds that have appreciated in value, then you will have to pay capital gains on that appreciation. (Not so for IRA’s and 401k’s – all withdrawals are treated as ordinary income, like they’re salaries.) So consider a recent retiree that has ordinary income of $35000 from part-time work, and supplements this by cashing in $40000 from a mutual fund savings account to give a combined income of $75000. If the mutual fund account has doubled in value over the years, then half of that $40000 will be capital gains, and he’ll be in the position of having a taxable income of $23000 and capital gains of $20000 and will hit (or straddle) the doughnut hole.

Yeah, but so what – you owe whatever you owe in taxes, doughnut hole or not

Ah… true, but you do have some control over what you owe, based on what you take as deductions (if you don’t use the standard deduction) and what you exclude from your income in the form of retirement contributions. If you are straddling the doughnut hole, every $100 you reduce your income by saves you $27 that you’d otherwise pay in taxes. So if you make a $100 donation to a charity, you’ll pay $27 less in tax if you itemize; thus you’ve given the charity $100 of capability that’s only costing you $73. That’s pretty good leverage! (Or if you prefer, you can think of it as the US government matching your $73 donation with a $27 donation of their own – I like this imagery.) Even if you don’t itemize deductions, you can choose to shield some of your income by making a contribution to an IRA or 401k, which directly reduces your ordinary income – remember, every $1000 you put in reduces your tax bill by $270 while you straddle the doughnut hole. Even though you will have to pay tax on this money when you eventually withdraw it, you’re pretty unlikely to have to pay a rate as high as the 27% that you’re faced with today.

Hmmm… OK, maybe I should look into this – how do I know if it applies to me?

That’s easy – just use available tax-estimation software to test to see what happens if you make some changes. My favorite is the the H&R Block Tax Estimator . A useful exercise is to put in your current info (salary, capital gains, deductions, etc.) and then make some small changes to see what happens. For instance, see what happens to your final tax bill if you increase or decrease your salary by $100; this will tell you your net marginal tax rate. If your bill goes up (or down) by something other than what would be expected by the tax bracket table (for example, $27 as in the above), you’re probably “in the hole” and might want to take some action. In any case, this can help you decide if shielding your income (through an IRA or 401k addition) makes particular sense right now. But of course, before making any moves, you’ll want to consult with a tax professional to make sure there isn’t something you’ve overlooked. After all, the tax code is full of pitfalls, restrictions, and other doughnut holes that are waiting for us to fall in.

Caveat

This information is presented as-is, with no guarantee as to accuracy or freedom from errors. This document is intended as an observation for informational purposes only, and should not be used in tax or retirement planning without cross-checking and correlating with other sources of information and consultation with a certified financial planner or tax accountant. I’m an enthusiast, not a professional, and being human make mistakes. Your taxes and retirement are far too important to rely significantly on any unvalidated information!